Vietnam Crypto Futures Contract Analysis

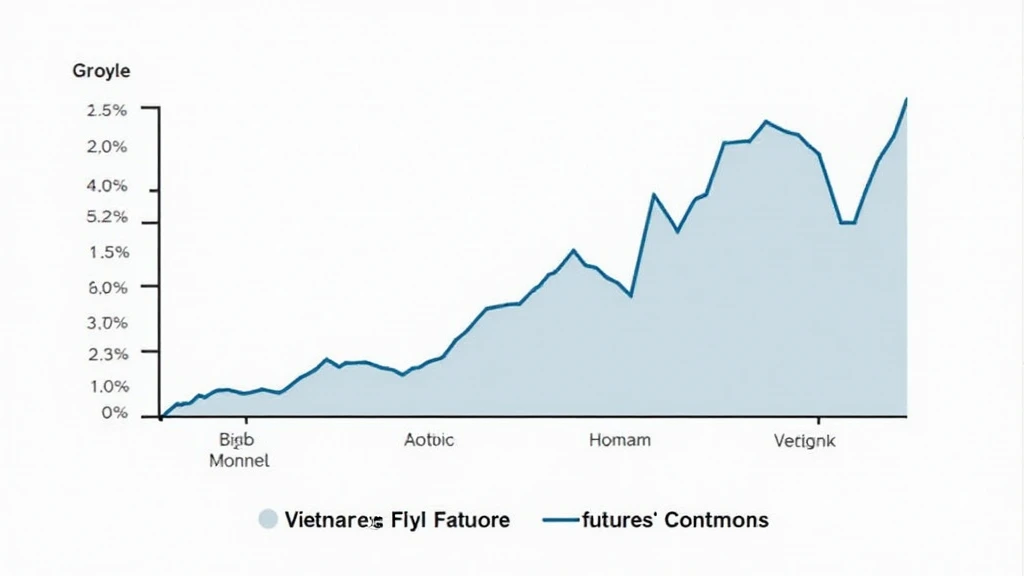

In the rapidly evolving landscape of cryptocurrency, Vietnam has emerged as a noteworthy player. With over 25% growth in the crypto user base in 2022 alone, it’s clear that the Vietnamese market possesses significant potential. However, with the rise in popularity of crypto futures contracts, several complexities surface. Let’s dive deep into this analysis, exploring both the opportunities and challenges.

Understanding Crypto Futures Contracts

A crypto futures contract is essentially a legal agreement to buy or sell a cryptocurrency at a predetermined price in the future. This market mechanism provides a myriad of benefits, including:

- Risk Management: Traders can hedge against price volatility.

- Leverage: Futures trading allows traders to control a larger position with a smaller amount of capital.

- Market Sentiment Analysis: Futures prices can indicate the future direction of underlying asset prices.

In Vietnam, as of 2023, the interest in crypto futures has surged. The increase in trading volumes indicates a robust market ecosystem.

Regulatory Landscape in Vietnam

Before diving into analysis, it’s crucial to grasp the regulatory environment surrounding crypto futures in Vietnam. The government has taken a proactive stance, implementing necessary policies to safeguard investors. According to the Digital Currency Council, regulations have been evolving to establish guidelines like “tiêu chuẩn an ninh blockchain”.

In 2023, the State Bank of Vietnam issued a directive aiming to:

- Monitor crypto transactions and prevent fraudulent activities.

- Enhance user education on crypto investments.

- Define the legal status of cryptocurrencies and related financial products.

Such regulations signify a positive shift, as the government acknowledges the increasing role crypto plays in the economy.

Vietnam’s Market Trends

The Vietnamese crypto market is characterized by unique trends shaped by local investor behavior and global influences. Here are a few notable trends:

- Increased Retail Participation: A growing number of Vietnamese individuals are entering the crypto space, looking at futures as a viable investment strategy.

- Rise of Local Exchanges: Platforms like HIBT have successfully catered to local demands, offering tailored futures products.

- Integration with Traditional Finance: The blending of crypto and traditional financial instruments has garnered curiosity among institutional investors.

As the market becomes more sophisticated, understanding these dynamics is crucial for potential traders and investors.

Market Analysis: Opportunities and Risks

Crypto futures contracts present both exciting opportunities and inherent risks. Understanding these can be crucial for both seasoned traders and newcomers:

Opportunities

- Diversification: Futures contracts can help diversify an investment portfolio, mitigating risks associated with holding a single asset.

- Speculative Gains: Traders can potentially earn significant returns through price speculation.

Risks

- Market Volatility: Crypto markets are notoriously volatile, and futures can amplify this risk.

- Regulatory Changes: Sudden shifts in regulations can impact trading practices.

- Leverage Risks: While leverage can amplify profits, it can equally magnify losses.

It’s essential for traders to execute stringent risk management strategies when engaging in futures trading.

Key Takeaways and Future Outlook

Vietnam’s crypto futures market is burgeoning and reflects broader global trends while catering specifically to local needs. With the right mix of regulation, education, and innovative trading platforms, the future looks promising. However, it is essential to:

- Stay updated with regulatory changes.

- Utilize trusted platforms like HIBT for comprehensive trading insights.

- Engage in continuous learning to navigate this complex landscape.

Finally, remember, investing in crypto futures is high risk. Always consult with a financial advisor before making any significant decisions in this arena. As always, this isn’t financial advice; ensure to stay compliant with local regulations.

With rapid advancements, understanding the Vietnam crypto futures contract analysis is vital for navigating this evolving space effectively.

In conclusion, as the Vietnam crypto futures market continues to grow, platforms like cryptopaynetcoin play a pivotal role in providing insights and opportunities for traders looking to harness this digital asset revolution.

Meet the Author

Dr. Phuong Tran is a blockchain expert with over 10 years of experience in the cryptocurrency domain. She has published 30 papers on blockchain technology and led multiple successful audits for prominent projects globally.