Understanding HiBT Maker and Taker Fees: Your Guide to Cryptocurrency Trading

As the cryptocurrency market continues to thrive, traders are looking for efficient platforms that offer competitive trading fees. According to recent reports, the global cryptocurrency market grew by over 200% in 2021, and Vietnam now ranks among the top 10 countries in terms of cryptocurrency adoption. This trend showcases the growing interest in platforms like HiBT, which has established itself as a key player in the trading space. We’ll delve into the details surrounding HiBT’s maker and taker fees and why they matter for your trading journey.

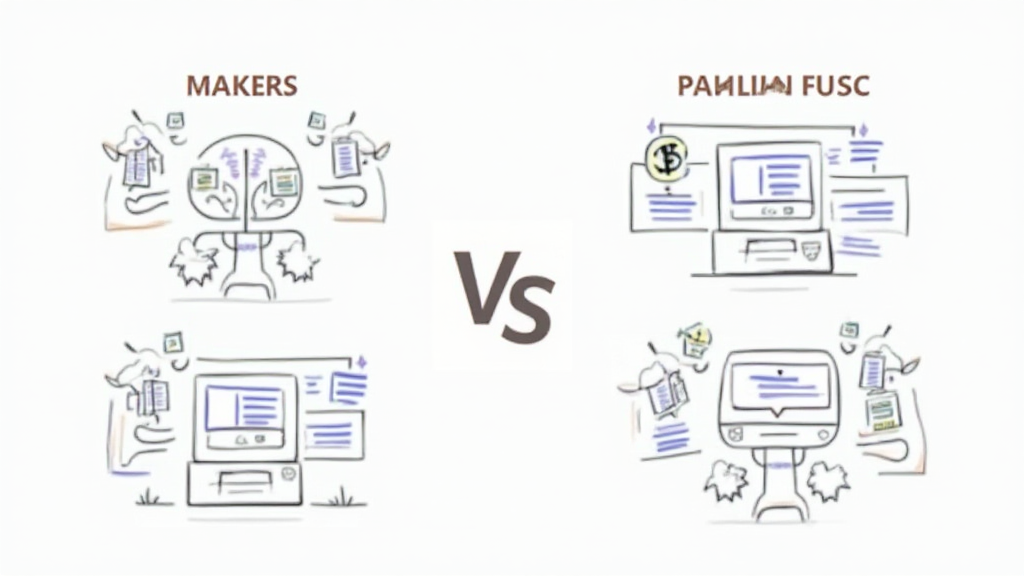

What Are Maker and Taker Fees?

Before we dive into the specifics of HiBT’s fees, it’s essential to understand what maker and taker fees mean. In the world of trading, a maker is someone who places an order that adds liquidity to the market. On the other hand, a taker removes liquidity when they place an order that matches an existing order in the order book.

To put this in perspective, think of it like a restaurant. The maker is the chef preparing a delicious meal (the order), while the taker is the diner coming in to enjoy the meal (matching the order). By understanding these roles, traders can navigate HiBT’s fee structure effectively.

HiBT Fee Structure Overview

HiBT employs a competitive fee model that differentiates between makers and takers. Here’s a breakdown of their fee structure:

- Maker Fee: This fee is charged to traders who provide liquidity by placing limit orders. For example, if a trader places a limit order to buy Bitcoin at a lower price, they become a maker since their order provides liquidity to the order book.

- Taker Fee: This fee is applied to traders who place market orders or orders that match existing limit orders. If someone places an order to buy Bitcoin at the current market price, they incur the taker fee.

Both fees are expressed as a percentage of the total transaction value. For instance, if the maker fee is 0.1% and the taker fee is 0.2%, a trader would pay $1 on a $1,000 trade as a maker and $2 during the same trade as a taker.

The Importance of Understanding Fees in Trading

Understanding the implications of maker and taker fees can significantly influence your trading strategy. Here’s why they matter:

- Cost Efficiency: By strategically placing orders as a maker, you can reduce your trading costs. Over time, this can lead to substantial savings, especially for high-frequency traders.

- Liquidity Considerations: Makers contribute liquidity, improving market efficiency and reducing price volatility. This is crucial for traders looking to execute larger orders without causing significant price shifts.

- Trading Strategy: Different trading strategies might benefit from varying fee structures. Day traders, swing traders, and long-term investors should tailor their approaches around these fees.

Real-World Examples of HiBT Fees in Action

To illustrate the impact of maker and taker fees, let’s consider a hypothetical trading scenario on HiBT:

A trader decides to buy Bitcoin worth $10,000. If they place a limit order and don’t immediately match it, they will incur a maker fee of 0.1%, costing them $10. On the other hand, if they decide to act quickly and place a market order to buy at the current price, they will incur a taker fee of 0.2%, costing them $20. This difference clearly demonstrates how understanding these fees can affect trading costs.

The Vietnamese Market and Its Growing Interest in Crypto

Vietnam has seen a significant increase in cryptocurrency adoption, with a rise in trading volumes and user engagement. In 2023, it was estimated that Vietnam’s cryptocurrency user growth rate reached 49%, showcasing a vibrant market filled with traders seeking cost-effective platforms.

Here are some additional insights about the Vietnamese crypto landscape:

- Over 7 million Vietnamese people participated in cryptocurrency trading in the past year.

- The young demographic, particularly those aged 18-35, comprises the majority of active traders.

- Regulatory measures are being implemented, which enhances the security and reliability of trading platforms.

Tips for Minimizing Fees on HiBT

Now that you understand the significance of maker and taker fees, let’s discuss some tips to minimize your trading costs on HiBT:

- Limit Orders: Utilize limit orders strategically to become a maker and benefit from lower fees.

- Market Analysis: Analyze market trends and order book depth so that you can place your orders at optimal times.

- Fee Promotions: Keep an eye out for HiBT’s promotional campaigns and fee discounts during specific trading events or periods.

How to Get Started with HiBT

If you’re planning to trade on HiBT, here’s a quick start guide:

- Visit the HiBT website and create an account.

- Complete the verification process to start trading.

- Deposit funds into your account using various payment methods.

- Familiarize yourself with the trading interface and set up your first trade.

Conclusion: Navigating HiBT’s Fees for Successful Trading

Understanding HiBT maker and taker fees is crucial for any trader looking to maximize their profits and minimize their costs. By becoming familiar with these fees, you can formulate a trading strategy that aligns with your financial goals while leveraging the opportunities available in the fast-paced cryptocurrency market.

As the market evolves, being aware of the costs tied to transactions is not just prudent; it’s essential. With HiBT’s competitive fee structure and the growing interest in cryptocurrencies in markets like Vietnam, now is the perfect time to start trading and take advantage of these opportunities.

For more details on trading strategies and market insights, check out our articles on related topics. Get involved and join the vibrant community at cryptopaynetcoin, where we empower traders with the knowledge and tools they need to succeed.

Author: Dr. Lee Tran, a blockchain expert and consultant, has authored over 15 papers on cryptocurrency and smart contracts. Dr. Tran has led multiple high-profile audits and projects in the blockchain space, establishing a reputation for excellence and authority.