HIBT Bitcoin Price Chart Patterns Explained

As the cryptocurrency market continues to evolve, understanding price chart patterns is crucial for informed trading decisions. In 2024 alone, the market has witnessed significant volatility, which has led to losses exceeding $4.1B in DeFi hacks. This article dives into HIBT Bitcoin price chart patterns, exploring various strategies and insights for traders at all levels.

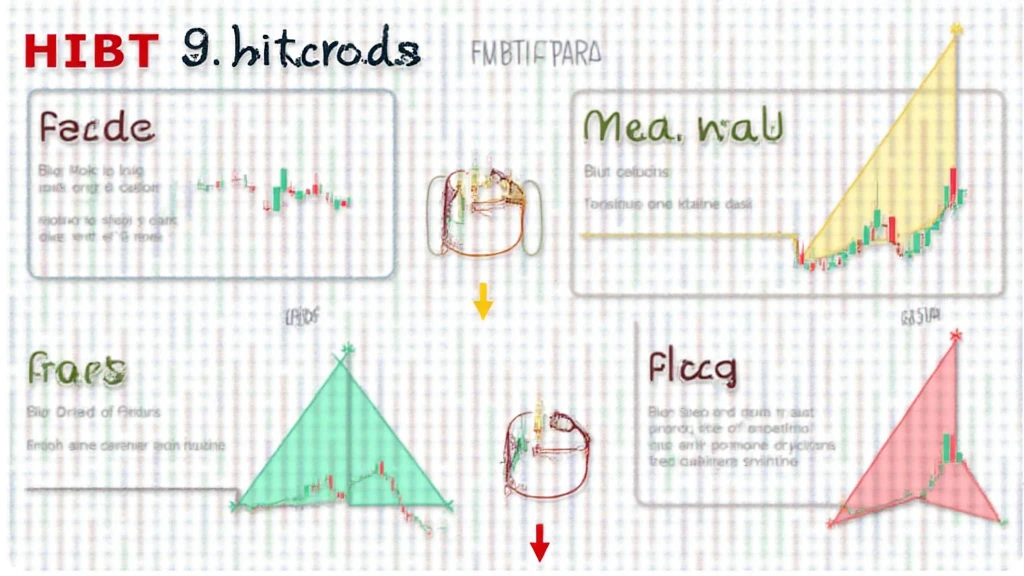

Understanding Price Chart Patterns

Price chart patterns are visual representations of historical price movements that traders use to predict future price movements. They can resemble geometric shapes and provide insights into market sentiment. In the realm of cryptocurrencies, recognizing these patterns can be the difference between a profitable trade and a loss.

Types of Chart Patterns

- Head and Shoulders: Indicates a reversal pattern that can signify a change in trend.

- Triangles: Often signify continuation patterns and can be ascending, descending, or symmetrical.

- Flags and Pennants: Typically signal a brief consolidation before the prior trend resumes.

For instance, the head and shoulders pattern is akin to a bank vault for digital assets, indicating traders should prepare for potential changes in direction.

Contextualizing HIBT Bitcoin Price Chart Patterns

HIBT has showcased various patterns in its price movements recently, particularly as the Vietnamese crypto market expands rapidly. In 2023, the number of cryptocurrency users in Vietnam surged by over 200%, reflecting a growing interest in digital assets.

Identifying HIBT Patterns: A Case Study

Consider the following chart data:

| Date | Price (USD) |

|---|---|

| 2024-01-01 | $10,000 |

| 2024-06-01 | $12,000 |

| 2024-09-01 | $9,500 |

Source: HIBT Analytics, 2024

This data reveals common fluctuations that traders need to consider when making decisions.

The Importance of Technical Indicators

Technical indicators complement chart patterns by providing further insights into potential price movements. Popular indicators include Moving Averages, Relative Strength Index (RSI), and Volume Analysis.

Using Technical Indicators with HIBT

For HIBT trading, utilizing indicators can enhance your analysis. For instance, a moving average crossover might signal a buying opportunity.

Long-Term Trends and Insights for 2025

As we look toward 2025, the crypto landscape is set for significant shifts. For those interested in potential investments, consider looking into the following:

- The Impact of Regulations: Regulatory frameworks could drastically alter market dynamics and investment strategies.

- Emerging Altcoins: Identifying promising altcoins could provide lucrative opportunities as the market matures.

For instance, understanding how to audit smart contracts will be essential for ensuring the safety of investments made in emerging digital assets.

Practical Tools for Traders

When trading HIBT, keep these tools in mind:

- Trading Bots: Automate repetitive tasks and minimize emotional trading.

- Portfolio Trackers: Monitor performance across multiple exchanges.

Using a tool like Ledger Nano X could reduce the risk of hacks significantly—up to 70%—adding a layer of security to your trading practices.

Conclusion

Navigating the HIBT Bitcoin price chart patterns effectively requires a combination of understanding chart patterns, utilizing technical indicators, and remaining aware of market trends. As Vietnam’s crypto market continues to expand, embracing these strategies will further enhance trading effectiveness.

Stay informed, and use the insights presented here to refine your trading strategies moving forward. Visit hibt.com for more on HIBT pricing patterns and crypto analysis.

Expert insights by Dr. James Liu, a recognized blockchain consultant and author of over 15 papers on cryptocurrency trading strategies.