Centralized Exchanges (CEX) Comparison: Navigating the Future of Crypto Trading

In recent years, centralized exchanges (CEX) have become the go-to platforms for trading cryptocurrencies. As of 2024, over 70% of crypto transactions occur on these exchanges, highlighting their dominance in the digital asset market. But how do you choose the best central exchange for your trading needs? With crypto users expected to grow by 15% in Vietnam alone, understanding your options is critical.

Why Centralized Exchanges? The Basics Explained

Centralized exchanges are online platforms that facilitate the buying, selling, and trading of cryptocurrencies. Think of them as banks for digital assets. They handle transactions, provide liquidity, and ensure security. However, this comes with risks, as users must trust the exchange’s security measures to safeguard their funds. In Vietnam, for instance, the rapid rise of crypto traders is pushing platforms to enhance their security features, often measured against tiêu chuẩn an ninh blockchain standards.

Key Advantages of Centralized Exchanges

- User-Friendly Interfaces: Most CEX platforms offer intuitive designs, making them accessible for beginners.

- High Liquidity: Centralized exchanges typically have a significant trading volume, improving market efficiency.

- Advanced Trading Features: These exchanges provide tools for diversified trading, including limit orders and margin trading.

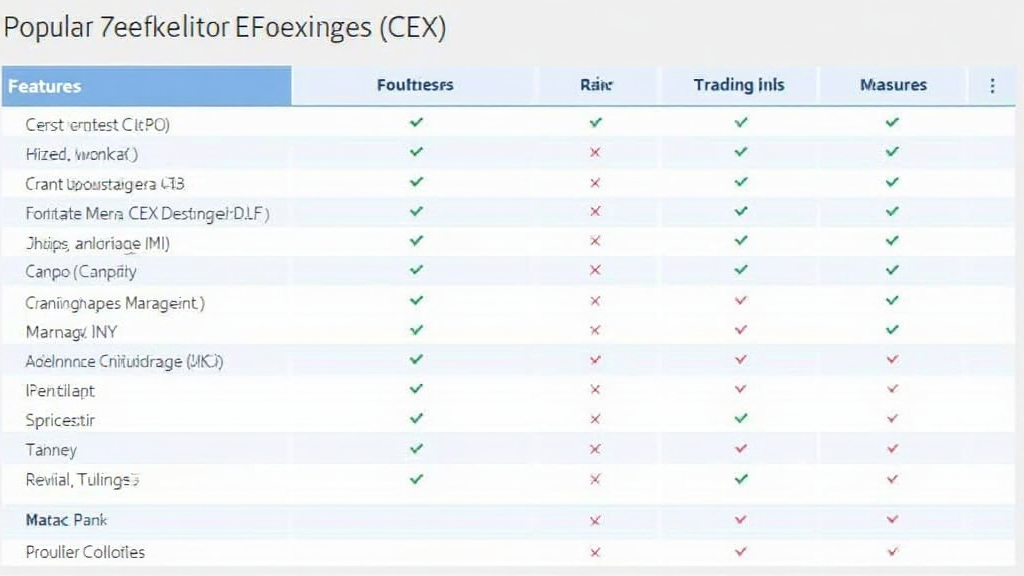

Comparing Popular CEX Platforms

When it comes to selecting a centralized exchange, it’s essential to compare various platforms. Let’s look at some of the leading players:

Binance

- Founded: 2017

- Trading Pairs: Over 600

- Security Features: 2FA, withdrawal whitelist, and insurance fund for digital assets.

Coinbase

- Founded: 2012

- Trading Pairs: 50+

- Security Features: Cold storage and regular security audits.

Kraken

- Founded: 2011

- Trading Pairs: 150+

- Security Features: Two-factor authentication and anti-DDoS measures.

Security Considerations

Security is a top concern when using CEX platforms. Here are some critical points to consider:

- Regulatory Compliance: Ensure the exchange is compliant with local laws. In Vietnam, the State Bank of Vietnam is actively regulating crypto businesses.

- Cold vs. Hot Wallets: CEXs should ideally hold a majority of their assets in cold wallets to prevent hacks. For instance, Binance reports that 95% of its assets are stored offline.

- Regular Audits: Select exchanges that conduct frequent security audits. This transparency can be a good indicator of their reliability.

Market Trends Impacting Centralized Exchanges

As the crypto market evolves, several trends are impacting the landscape of centralized exchanges:

- DeFi Integration: More CEX platforms are integrating DeFi protocols to enhance user experience and offer staking options.

- Decentralized Identity Verification: Innovations in user identification are enabling easier and more secure onboarding for new users.

- Global Expansion: Many exchanges are looking to enter emerging markets like Vietnam, where crypto adoption is rapidly increasing.

Future of Centralized Exchanges

The future of centralized exchanges appears bright, but not without challenges. Competition from decentralized exchanges is significant, and regulatory scrutiny is tightening. However, platforms that can adapt and enhance user experience while maintaining robust security measures will likely lead the market.

Conclusion: Choosing Your Centralized Exchange Wisely

As a crypto trader, choosing the right centralized exchange is vital. Consider factors such as security, user interface, and supported cryptocurrencies. With the Vietnamese market growing significantly, traders must stay informed to leverage opportunities effectively. Evaluating exchanges based on data and industry standards is crucial for successful trading.

For more information on the rapidly evolving cryptocurrency landscape, visit hibt.com.

**Remember**: This information is not financial advice. Always consult local regulators before making investment decisions.

Author: Dr. Nguyen Tran

Blockchain Security Expert with over 10 published papers and contribution to leading security audits for major crypto exchanges.