Optimizing Your Crypto Tax with HIBT Software Integrations

With the rise of cryptocurrencies, recent studies indicate that over $4.1 billion was lost due to DeFi hacks and security breaches in 2024 alone. This spike in incidents raises a critical question for crypto holders and investors: how can they protect their assets while ensuring compliance with tax regulations? That’s where HIBT crypto tax software integrations come into play, offering both security and usability for managing cryptocurrencies.

Understanding HIBT Crypto Tax Software Integrations

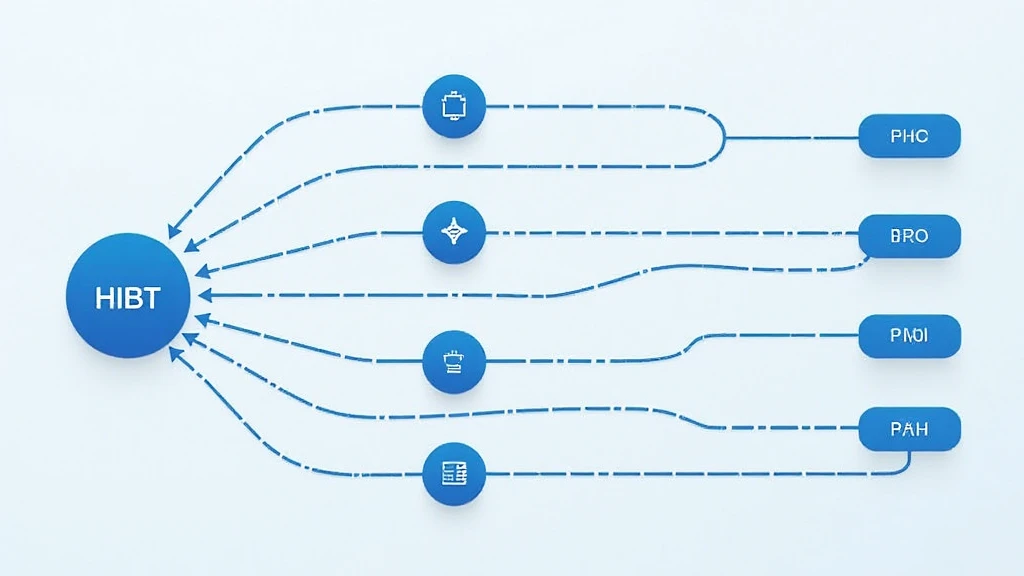

At its core, HIBT (Highly Integrated Blockchain Tax) software is designed to simplify the often complicated world of crypto taxation. As the cryptocurrency landscape continues to evolve, finding an effective tool that integrates seamlessly with various platforms is vital for finance enthusiasts. HIBT integrates with wallets, exchanges, and accounting software, creating a streamlined experience for users.

Advantages of Using HIBT Software

- Efficiency: Automate tax reporting tasks and reduce the burden of manual entries.

- Accuracy: Eliminate human error by relying on software processing.

- Compliance: Stay updated with tax policies and regulations relevant to your region.

The Rise of Cryptocurrency in Vietnam

In recent years, Vietnam has seen a significant increase in cryptocurrency users, with a growth rate of roughly 40% year-on-year. This surge emphasizes the importance of utilizing efficient tools like HIBT for tax management.

How HIBT Addresses Vietnam’s Crypto Tax Challenges

Vietnamese crypto users face numerous challenges, including tax compliance regulations that can be daunting. HIBT offers localized support to ensure that users navigate the complexities of crypto taxation.

Integrations That Make a Difference

HIBT crypto tax software can integrate with popular platforms like:

- Binance

- Coinbase

- Ledger

- QuickBooks

Each of these integrations plays a crucial role in seamless transaction tracking and accurate reporting.

The Role of Hot and Cold Wallets in Cryptocurrencies

Just as a bank vault protects physical assets, hot and cold wallets secure digital currencies. HIBT software automatically tracks wallet balances and transactions, minimizing the risk of loss and maximizing compliance.

Real-World Examples of Using HIBT

Many users have successfully integrated HIBT into their crypto management strategies:

- Case Study 1: A Vietnamese entrepreneur reduced their reporting time by 60% by leveraging HIBT’s tools.

- Case Study 2: An investment firm noted a 100% increase in compliance accuracy, leading to fewer audits.

Best Practices for Integrating HIBT Software

For optimal results, consider these strategies when using HIBT:

- Regularly update the software to align with evolving tax regulations.

- Utilize the support features for troubleshooting.

- Adopt a proactive approach to security, such as using two-factor authentication.

Conclusion

Ensuring compliance while managing crypto taxes doesn’t have to be a daunting task. By utilizing HIBT crypto tax software integrations, users can streamline their reporting process and focus on what truly matters—growing their investment portfolio. For crypto enthusiasts in Vietnam and beyond, HIBT serves as a reliable partner.

With the cryptocurrency ecosystem constantly evolving, investing in robust tax solutions is a smart move. For more information on efficient tax solutions, visit HIBT.com. Importantly, remember to consult local regulations to ensure compliance.

Author: Dr. Nguyen Hoang, a financial technology expert with over 15 publications in blockchain management, has spearheaded audits for several reputable projects in the region.