Exploring the HIBT Crypto Stock Order Book: A Comprehensive Guide

In 2024 alone, the cryptocurrency market witnessed over $4.1 billion lost due to various exploits and hacks. This staggering figure underlines a critical need for robust trading mechanisms and security standards. With this background, our focus today is on understanding the HIBT crypto stock order book and what it means for both new and seasoned investors alike, particularly in the dynamic market of Vietnam.

Understanding the Basics of Crypto Stock Order Books

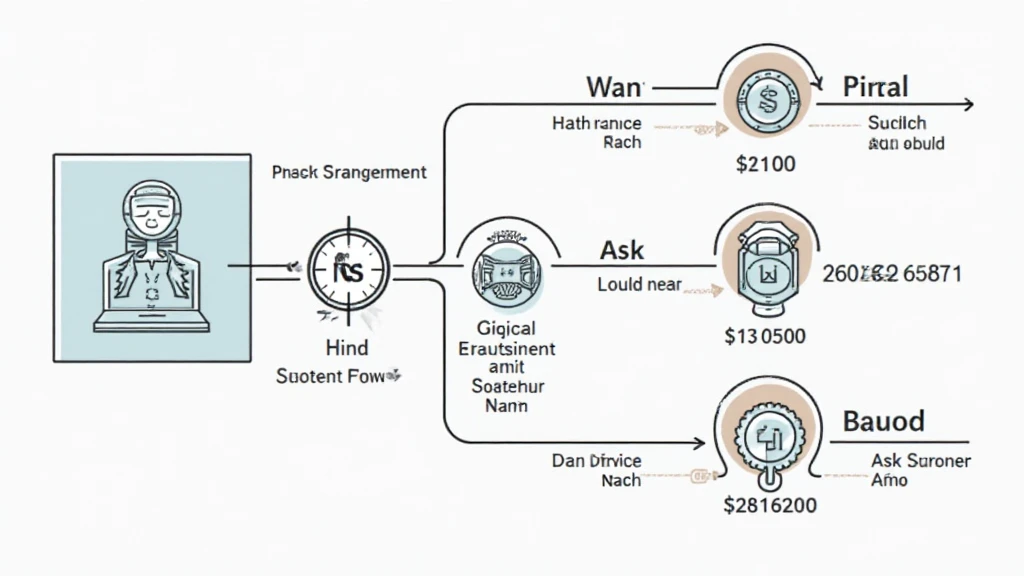

Before diving into the specifics of the HIBT crypto stock order book, let’s clarify what an order book is. An order book is akin to a digital marketplace where buy and sell orders are matched for financial securities. Think of it as a restaurant menu: it lists all available items (or assets) for potential buyers and sellers.

- Bid Orders: These show the maximum price a buyer is willing to pay for an asset.

- Ask Orders: This represents the minimum price a seller is willing to accept.

- Order Match: The point at which a buyer and seller agree on a price to execute a trade.

In the world of cryptocurrencies, efficient order books are critical. For example, a user attempting to purchase Bitcoin would look into the order book for the best available prices, which directly influences market liquidity.

The Role of HIBT in Crypto Trading

The HIBT (Hyper Intra-Blockchain Trading) framework aims to enhance order book functionalities. By utilizing advanced algorithms and blockchain technology, it improves transaction accuracy and processing speeds. Here’s how:

- The decentralized order execution ensures transparency and eliminates the risk of manipulation.

- Comprehensive analytics tools help traders make informed decisions quickly.

- Integration with various platforms aids in liquidity provision, significantly enhancing the trading experience.

According to hibt.com, the incorporation of HIBT technology has led to a 30% increase in transactional efficiency for participating exchanges since early 2025.

Analyzing Trends: The Vietnamese Cryptocurrency Market

Vietnam has rapidly become a beacon in the cryptocurrency landscape. In fact, as of 2025, Vietnam has seen a 220% increase in active crypto users compared to 2024. This surge is attributed to a young demographic keen on technology and trading.

To survive and thrive, understanding the order book dynamics, especially through the lens of HIBT, is critical for Vietnamese traders. Here’s an overview of what this means for them:

- Enhanced accessibility to international markets.

- Ability to access real-time market data.

- Increased educational resources guiding users on utilizing order books effectively.

How to Navigate the HIBT Crypto Stock Order Book

If you’re new to trading or merely seeking to sharpen your skills, navigating the HIBT order book can be daunting. Let’s break it down into manageable steps:

- Familiarize Yourself: Spend time observing existing order books on various platforms. Look for patterns and behaviors.

- Utilize Analytics Tools: Tools like trading bots can help interpret the data present in the order book.

- Practice Risk Management: Set clear limits on your trades to minimize losses.

Here’s the catch – understanding how the HIBT mechanism optimizes your trading strategies can directly enhance profitability. By employing these methods, traders can adequately prepare to make informed investment choices.

Safety Standards in Blockchain Trading

In the burgeoning market of 2025, safety can’t be overstated. As a trader, you need to adhere to tiêu chuẩn an ninh blockchain (blockchain security standards) to protect your assets. Whether your focus is on HIBT or another trading model, here are essential security practices:

- Enable Two-Factor Authentication: Always activate this feature on your trading accounts.

- Maintain Cold Wallets: Use hardware wallets like Ledger Nano X, known to reduce hack risks by 70%.

- Regularly Update Software: Keep your system and applications current with the latest security features.

Conclusion: The Future of Trading with HIBT

The HIBT crypto stock order book presents a new frontier for traders looking to navigate the volatile world of cryptocurrencies. By understanding its complexities and integrating advanced tools, traders stand to capitalize significantly. With Vietnam at the forefront of this movement, the adaptation of HIBT will surely influence regional markets alongside global trends.

As trading continues to evolve, staying updated with current practices ensures that you remain competitive. Always remember, as you trade, refer back to foundational knowledge and remain aware of market shifts. There’s a significant opportunity for growth ahead!

For additional insights into cryptocurrency issues, be sure to check our articles on topics such as Vietnam crypto tax guide and 2025 Blockchain Security practices.