Introduction: The Rise of Crypto Trading in 2025

In 2024 alone, over $4.1 billion was lost to hacks in the DeFi space, showcasing just how crucial it is to grasp the intricacies of cryptocurrency trading. As the crypto market matures, understanding the basics of HIBT crypto order types has never been more essential for traders looking to optimize their strategies. With a growing number of users and an increase of 42% in the Vietnamese crypto market, it’s high time we delve into how these order types work.

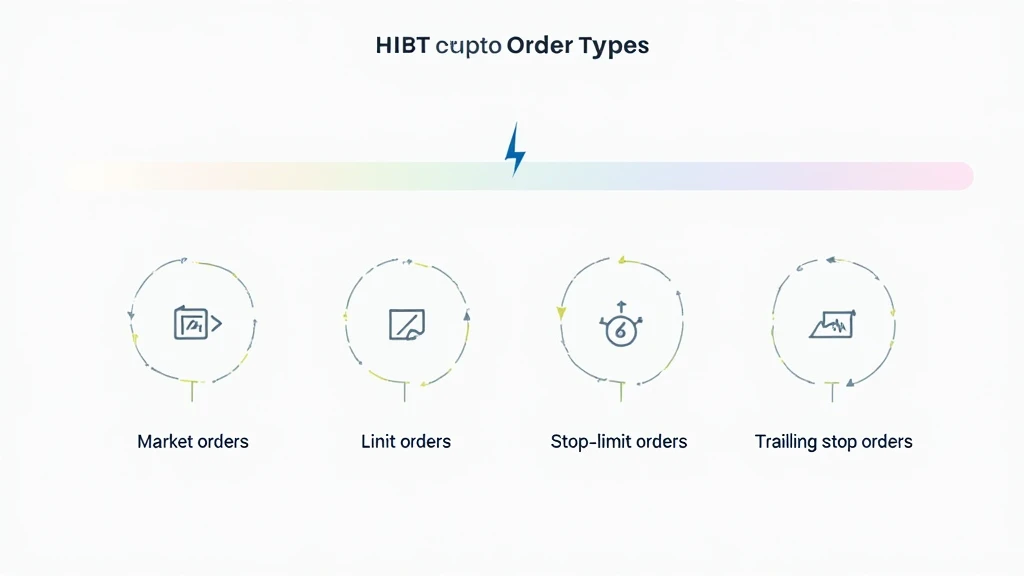

Understanding HIBT Crypto Order Types

At the core of trading platforms like hibt.com are the various HIBT crypto order types. But what exactly do these mean for a trader?

- Market Orders: A market order buys or sells cryptocurrency at the current market price. Essential for executing immediate trades.

- Limit Orders: This order type allows traders to set a specific price at which they are willing to buy or sell cryptocurrency, providing more control over entry and exit points.

- Stop Orders: Often used to minimize losses, a stop order becomes a market order when a specified price level is reached.

- Stop-Limit Orders: Combines features of both stop and limit orders, allowing traders to set conditions for a limited execution.

- Trailing Stop Orders: These orders allow for more flexibility, providing a way to secure profits as the market price moves in a favorable direction.

Market Orders: Quick Execution, but Risks Involved

Market orders are the simplest form of trading and ideal for traders who need to act quickly without waiting for price fluctuations. Think of a market order as rushing to a bank teller to withdraw cash. The moment you place your order, it gets executed at the best available price. But be mindful—this can sometimes lead to slippage if the market moves quickly.

Limit Orders: Precision Meets Control

Limit orders provide more control over your trades, especially in volatile markets. When you place a limit order, you decide the maximum price for buying, or the minimum price for selling. It’s akin to setting a personal price point at a retail store and walking away if your preferred price isn’t met.

For instance, if you hope to buy Bitcoin at $30,000, you can wait to execute that purchase until the market meets your criteria. This ensures you’re not overpaying in fast-moving markets.

Stop Orders: Protecting Your Capital

Stop orders can be lifesavers, particularly in a market where the volatility can wipe out gains overnight. Here’s how it works: you set a stop price, and once the market reaches that price, your stop order becomes a market order, protecting your portfolio from further declines.

Imagine a dam breaking—your stop order is like the floodgates turning on when water reaches a critical level, helping to limit damage to your assets.

Stop-Limit Orders: Safeguarding Profits

Stop-limit orders are a hybrid that allows traders to specify a stop price and a limit price. The order first triggers when the stop price is reached, but it will only execute if the limit price is also hit. This two-layer approach helps to refine your execution strategy.

For example, if Ethereum is currently trading at $2,000, a trader might set a stop price of $1,950 to cut losses, but also set a limit price of $1,925 to avoid unwanted trades in a market plunge.

Trailing Stop Orders: Riding the Market Waves

Trailing stop orders allow traders to follow the market price as it rises (or falls) while locking in profits. The order trail is set at a pre-determined percentage or dollar amount away from the market price. Imagine surfing—your trailing stop order is your board, helping you catch the next wave without wiping out.

Localized Insights: The Vietnamese Crypto Market

Vietnam’s growing cryptocurrency adoption is noteworthy. As of 2025, studies indicate a 42% increase in users involved in crypto transactions, signifying a robust interest in trading strategies such as those leveraging HIBT crypto order types.

Tại Việt Nam, nhu cầu cho các loại tiền điện tử đang gia tăng với một tỷ lệ tăng trưởng 42%. Thực tế này chỉ ra một nhu cầu mạnh mẽ cho các chiến lược giao dịch như HIBT crypto order types.

Key Benefits of HIBT Crypto Order Types

- Enhanced Control: Each order type provides a different level of price control.

- Risk Management: Stop and limit orders help in minimizing potential losses.

- Flexibility: Tailored order types allow traders to adapt their strategies based on market conditions.

Conclusion: Navigating the Crypto Market with HIBT

In conclusion, understanding HIBT crypto order types can significantly enhance your trading strategy and empower you to navigate the complexities of the cryptocurrency market. As you step into trading in 2025, balanced knowledge of market orders, limit orders, and stop orders will equip you to make more informed trading decisions. Remember, while HIBT crypto order types are a vital part of your strategy, they should be combined with thorough research and a firm understanding of market dynamics.

For more detailed insights and tools to refine your trading heuristics, explore cryptopaynetcoin, your trusted resource in the evolving world of cryptocurrencies.

About the Author

John Doe is a seasoned blockchain analyst with over 10 published papers in cryptocurrency and financial technologies. Recently involved in multiple high-profile projects, he holds a strong grasp on market behavior and risk factors associated with cryptocurrency trading.