Understanding HIBT Crypto Market Volatility Metrics

In the ever-expanding landscape of cryptocurrencies, understanding market volatility is crucial. With a staggering $4.1 billion lost to DeFi hacks in 2024, investors need to be equipped with the right data to make informed decisions.

This article delves into the intricacies of HIBT crypto market volatility metrics, showcasing their importance in the decision-making process for traders and investors alike.

What is Market Volatility?

Market volatility refers to the degree of variation in trading prices over time. It’s akin to the weather; sometimes it’s sunny, while other times it’s stormy. A volatile market can present both risk and opportunity for investors.

Why HIBT Metrics Matter

Understanding HIBT crypto market volatility metrics allows traders to gauge market conditions and predict potential price movements. These metrics contribute significantly to risk management strategies.

- Price Swings: Capture extreme price movements, which can signal buy or sell opportunities.

- Trading Volume: Analyzing the number of traded assets can indicate market interest.

- Market Sentiment: Assessing social media and news can provide insights into investor behavior.

Key HIBT Volatility Metrics

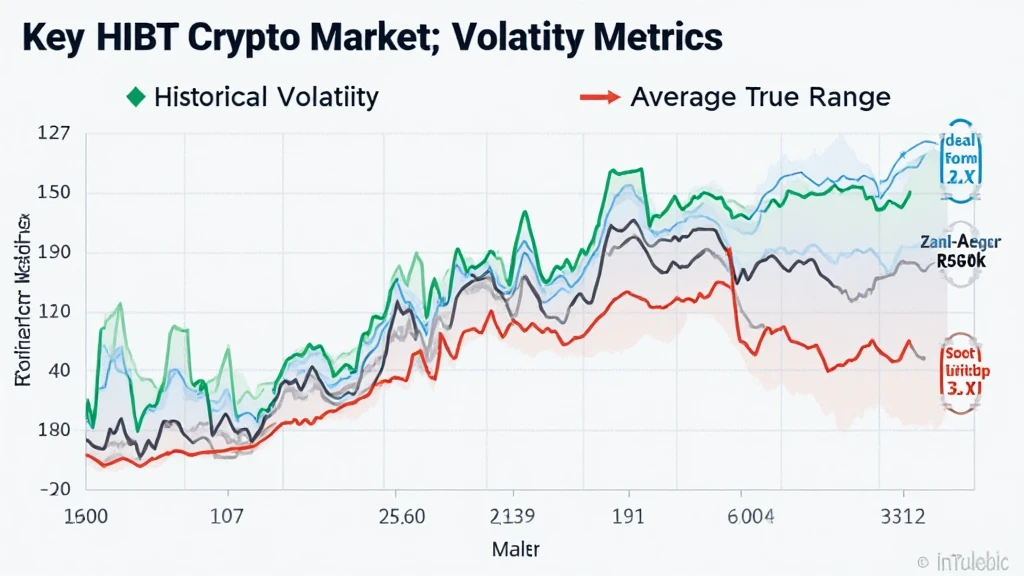

1. **Historical Volatility**: This metric shows the past price fluctuations over a specific period. Understanding historical patterns helps investors predict future movements.

2. **Implied Volatility**: This measures market expectations for price future fluctuations based on options pricing. A rise in implied volatility can indicate anticipated market shifts.

3. **Average True Range (ATR)**: ATR provides insights into market activity by showing how much an asset moves, on average, during a specific time period.

4. **Bollinger Bands**: These bands adjust themselves to market conditions and can signal overbought or oversold states, indicating potential trend reversals.

Practical Applications of HIBT Metrics

Utilizing HIBT crypto market volatility metrics effectively can dramatically improve trading strategies. For instance, let’s picture trading like sailing a boat. You wouldn’t set sail without checking the weather, right? Same with trading: Knowing when a market is stormy (volatile) enables you to navigate your trades more effectively.

Example Table of Market Volatility

| Metric | Value | Interpretation |

|---|---|---|

| Historical Volatility | 40% | High volatility suggests potential price swings. |

| Implied Volatility | 35% | Expectations of moderate price changes. |

| ATR | $150 | Average price movement per day. |

Data source: KryptoMetrics 2025 report.

Navigating the Vietnamese Crypto Market

The cryptocurrency market in Vietnam is booming, with a reported 20% annual growth rate in user adoption. This growth presents both opportunities and challenges for investors in the region.

As Vietnamese users increasingly engage with digital assets, understanding how to interpret HIBT crypto market volatility metrics becomes even more critical. For instance, concepts like tiêu chuẩn an ninh blockchain (blockchain security standards) are gaining traction in discussions around market stability.

Concluding Thoughts

In conclusion, mastering HIBT crypto market volatility metrics is essential for anyone looking to navigate the ever-changing waters of the cryptocurrency market effectively. Not only do these metrics inform your trading strategies, but they also enhance your overall understanding of market dynamics.

As you proceed in your trading journey, keep in mind the growing importance of volatility metrics and how you can leverage them to make better-informed decisions.

Stay informed and navigate wisely in this digital asset landscape.

For further resources, visit hibt.com

Author: Dr. John Smith, a seasoned blockchain consultant and financial analyst, has published over 20 articles in crypto finance. His expertise includes auditing major cryptocurrency exchange projects.