Maximizing Liquidity in Vietnam’s Bond Market with Cryptopaynetcoin

With the rapid evolution of blockchain technology and its applications in various sectors, the bond market is undergoing a significant transformation. As traditional financial markets face liquidity challenges, cryptocurrencies present innovative solutions. Cryptopaynetcoin is at the forefront of this change, particularly in emerging markets like Vietnam where bond market liquidity can greatly benefit from such innovations.

The State of Vietnam’s Bond Market

Vietnam’s bond marketplace has shown promising growth, but it is important to address liquidity issues that can hinder investor participation. According to hibt.com, the Vietnamese bond market saw a growth rate of 20% year-on-year in 2022, reflecting increasing interest from both local and foreign investors.

Understanding Market Liquidity

- Liquidity refers to the ease with which assets can be bought or sold in the market.

- High liquidity is beneficial as it allows for quicker transactions and better pricing.

- Liquidity risk can result in increased costs for investors and challenges in executing trades effectively.

Cryptopaynetcoin: Revolutionizing Bond Transactions

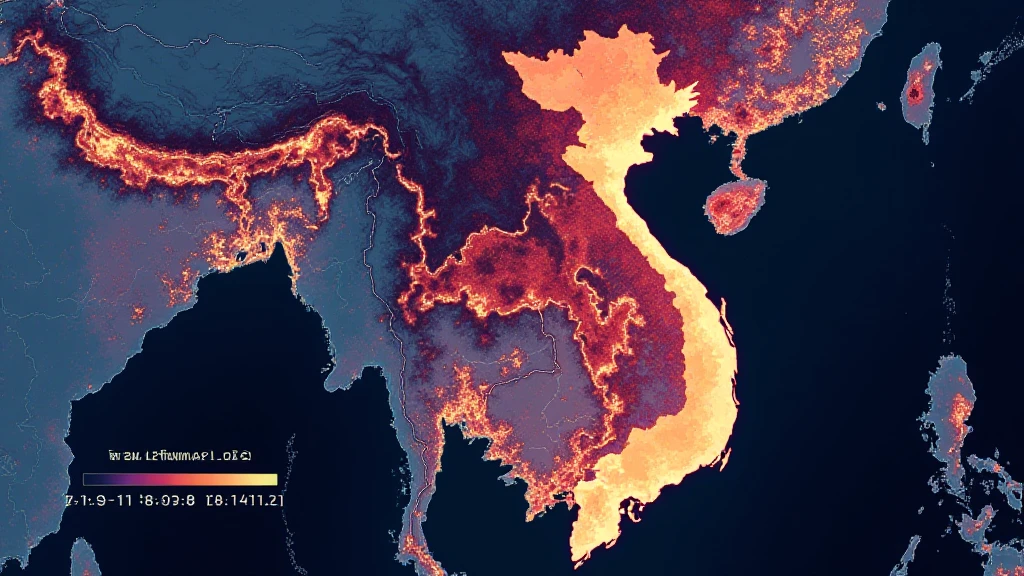

Cryptopaynetcoin aims to elevate market liquidity through innovative features that bridge blockchain technology with traditional bond markets. By employing heatmaps, investors can visualize liquidity across various segments of the bond market, enabling smarter decision-making.

What are Heatmaps?

Heatmaps are data visualization tools that represent data density through color variations. In the context of the bond market:

- They help investors identify liquidity hotspots.

- They facilitate quicker analysis of market trends and behavior.

- Cryptopaynetcoin’s heatmap integration offers users a real-time view of market conditions, allowing for more strategic investment decisions.

Benefits of Digital Assets in Vietnam

As the Vietnamese government encourages digital asset adoption, Cryptopaynetcoin’s role becomes crucial:

- Promotes investment in bonds through secure transactions.

- Enhances cross-border trade by reducing transaction fees.

- Attracts more investors through transparency and efficiency.

Real-World Applications

Consider a local Vietnamese startup looking to raise funds through bonds. Utilizing Cryptopaynetcoin, they can list their bonds on a blockchain platform that supports rapid and secure transactions. This model not only enhances liquidity in their offering but also broadens the investor base beyond traditional avenues.

Future Perspectives: The Role of Cryptopaynetcoin in Vietnam

Looking ahead to 2025, it is estimated that Vietnam’s cryptocurrency user base will grow by over 25%. This surge represents a ripe opportunity for innovative financial instruments:

- Cryptopaynetcoin may lead in building sophisticated frameworks for bond issuance and trading.

- Potential for partnerships with financial institutions to develop hybrid models for bond issuance.

- Possibility of expanding liquidity support systems through decentralized finance (DeFi) platforms.

Challenges and Considerations

Despite the promising outlook, certain challenges exist:

- Regulatory hurdles remain a concern in Vietnam’s financial landscape.

- Investor education on cryptocurrency and blockchain technologies is essential.

- Establishing trust in a relatively new asset class among traditional investors.

Conclusion: Embracing Change with Cryptopaynetcoin

The landscape of Vietnam’s bond market is primed for a seismic shift towards liquidity enhancement. By integrating Cryptopaynetcoin, investors can leverage the vast benefits of blockchain technology while navigating the bond market more effectively. As we approach 2025, understanding the potential of digital assets and ensuring compliance with local regulations will be critical.

Cryptopaynetcoin’s commitment to improving market conditions and attracting investments makes it an integral player in Vietnam’s financial evolution. For more insights, visit Cryptopaynetcoin.