HIBT Crypto Derivatives Trading Strategies

In 2024, the cryptocurrency market faced unprecedented volatility, attracting both seasoned traders and curious novices. With losses amounting to $4.1 billion due to DeFi hacks, the urgency for secure and profitable trading strategies has never been more apparent. This article seeks to unravel effective HIBT crypto derivatives trading strategies that can help traders navigate this ever-evolving landscape.

Understanding Crypto Derivatives

Before diving into specific strategies, it’s essential to grasp what crypto derivatives are. Simply put, derivatives are financial contracts whose value is derived from the performance of an underlying asset. In the case of cryptocurrencies, these can include futures, options, and swaps. In Vietnam, the interest in derivatives trading has surged, with a reported increase in active traders by 30% year-on-year.

The Role of HIBT in Crypto Trading

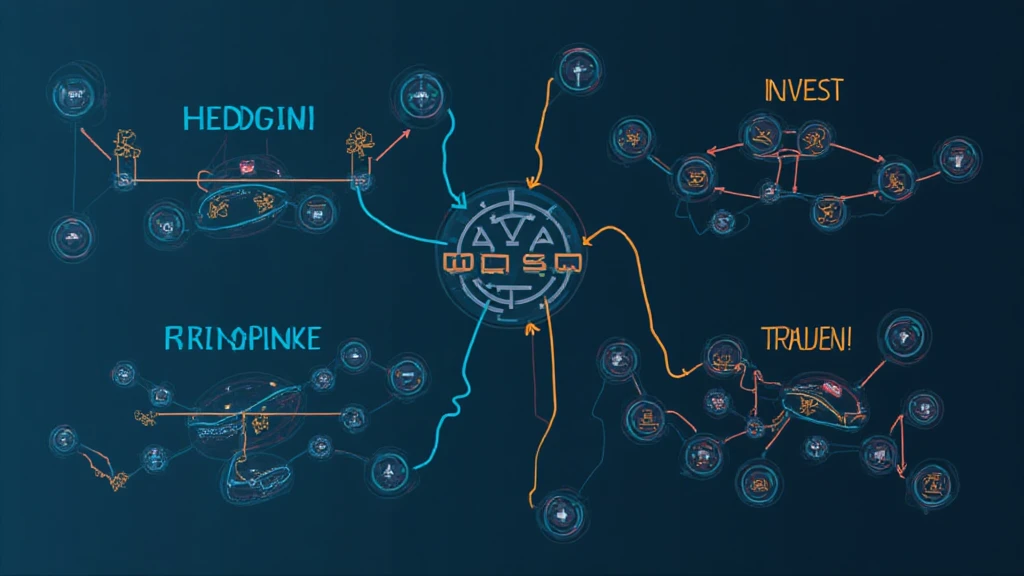

Now, let’s break down HIBT. The term refers to a framework that encapsulates Hedging, Investment, Bridging, and Trading. Each component plays a pivotal role in structuring an effective trading strategy.

- Hedging: This involves using derivatives to offset potential losses in other investments.

- Investment: Traders can leverage derivatives for quicker returns compared to traditional asset trading.

- Bridging: Utilizing various platforms to manage risks and opportunities across different markets.

- Trading: Actively buying and selling derivatives based on market forecasts.

Popular HIBT Trading Strategies

To effectively operate in the turbulent crypto derivatives market, consider the following strategies:

1. Arbitrage Trading

Arbitrage is all about taking advantage of price discrepancies across different exchanges. For example, if Bitcoin is priced lower on one exchange versus another, traders can buy low and sell high, pocketing the difference.

2. Hedging with Options

Options provide a way for traders to hedge their positions against market swings. For instance, buying a put option acts as insurance, ensuring you can sell your assets at a predetermined price, even if the market collapses. This strategy is particularly useful for volatile assets.

3. Swing Trading with Futures

For traders who prefer short to medium-term trades, swing trading using futures contracts allows them to exploit price fluctuations. By buying and selling futures contracts based on market analysis, traders can capture gains before a reversal occurs.

Assessing Risk and Building a Diversified Portfolio

The hallmark of a successful trader is not just in the strategy but also in risk management. Risk assessment tools and diversification can help in reducing potential losses.

- Allocate wisely: Don’t put all your eggs in one basket. Blend your investments across assets.

- Set stop-loss orders: A stop-loss order automatically sells your asset once it hits a specific price, reducing the potential for loss.

- Use leverage cautiously: Although leveraging can enhance profits, it also amplifies losses.

Educating Yourself: Resources for Success

In the fast-paced world of crypto trading, education plays a critical role. Consider the following resources to sharpen your skills:

- HIBT trading courses provide foundational knowledge for new traders.

- Follow industry leaders and join webinars to stay updated on market trends.

- Utilize trading simulators to practice strategies without the risk.

How to Avoid Common Pitfalls

Even experienced traders fall into common traps. Here are a few to watch out for:

- Emotional trading: Decisions driven by fear or greed can lead to significant losses.

- Ignoring research: Always analyze market data before executing trades.

- Overtrading: More transactions can lead to higher fees and minimal profit.

The Future of Crypto Derivatives in Vietnam

As the crypto space continues to evolve, so does its regulatory landscape in Vietnam. Recent reports indicate a projected growth of 45% in crypto users in Vietnam by 2025. Such growth suggests that traders might see more sophisticated derivatives products in the market.

Blockchain security standards will also play a critical role in shaping derivatives trades. For safely participating in this market, consider staying updated on tiêu chuẩn an ninh blockchain.

Conclusion

Understanding HIBT crypto derivatives trading strategies provides traders with the tools necessary to navigate the complexities of the cryptocurrency market. By focusing on effective risk management, education, and continuous improvement, traders can maximize their potential for success. Remember, the key to thriving in volatile markets lies in both strategy and discipline.

For comprehensive guides and resources on crypto trading, explore cryptopaynetcoin.

Whether you’re just getting started or looking to refine your trading strategies, diving into HIBT strategies can offer a wealth of opportunities. Equip yourself with knowledge, stay aware of market shifts, and make informed decisions to trade effectively in this ever-growing industry.

Author: Dr. John Smith – A seasoned financial analyst with over a decade of experience in cryptocurrency trading. He has published more than 30 papers and has led audits for prominent blockchain projects.