HIBT Bitcoin Market Cycle Analysis Tools: Your Essential Guide

In the fast-paced world of cryptocurrency, understanding market cycles is paramount for traders and investors alike. Did you know that in 2024 alone, the cryptocurrency market saw an estimated $4.1 billion lost to DeFi hacks? As the market continues to evolve, so do the tools we use to analyze its trends. This guide dives deep into HIBT Bitcoin market cycle analysis tools, offering you valuable insights for navigating the tumultuous waters of digital assets.

What Are HIBT Bitcoin Market Cycle Analysis Tools?

HIBT, or High-Impact Bitcoin Trends, refers to a set of analytical tools designed to assess and predict the cycles within the Bitcoin market. These tools allow investors to make data-driven decisions based on historical performance, market sentiment, and macroeconomic indicators.

Why Market Cycle Analysis Matters

- Timely Decisions: Understanding market cycles helps traders time their buy and sell orders more effectively.

- Risk Management: Analyzing cycles can help identify potential downturns, allowing for better risk management.

- Profit Maximization: Knowing when to enter and exit positions can significantly enhance profitability.

The Phases of Bitcoin Market Cycles

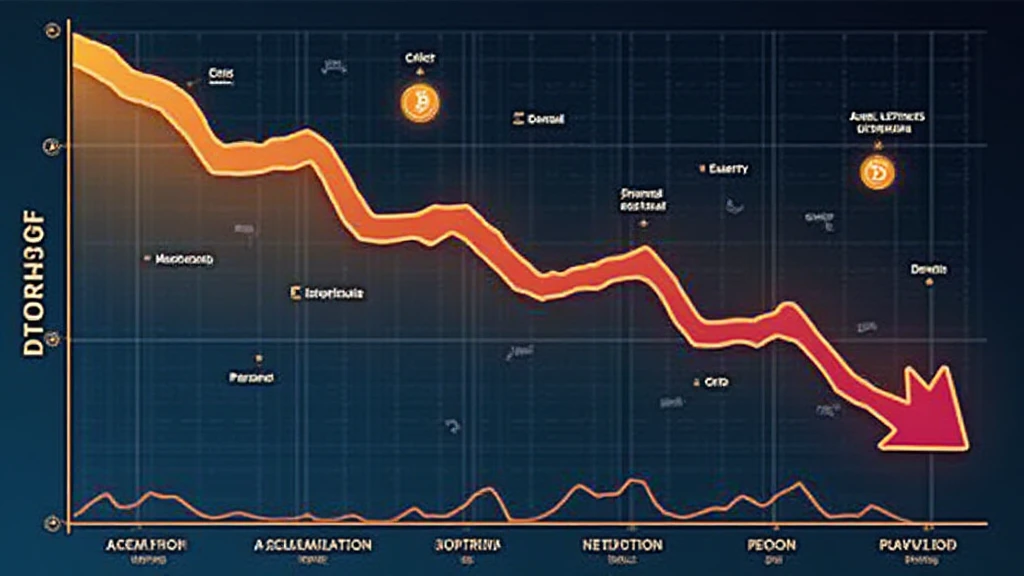

Typically, Bitcoin market cycles can be broken down into four phases: accumulation, uptrend, distribution, and downtrend. Let’s explore each phase in detail.

1. Accumulation Phase

During this initial stage, smart money starts buying Bitcoin at lower prices, often after a significant downturn. It sets the groundwork for price appreciation.

2. Uptrend Phase

Once accumulation strengthens, Bitcoin enters an uptrend, marked by increasing prices and trading volume. This phase is often characterized by widespread media attention.

3. Distribution Phase

As Bitcoin reaches new highs, early investors begin to sell their holdings, creating a distribution phase. Prices may still rise, but the market sentiment shifts.

4. Downtrend Phase

Finally, after reaching a peak, the market enters a downtrend, leading to significant price corrections. This phase can be characterized by fear and panic selling.

Utilizing HIBT Analysis Tools: A Comprehensive Approach

To successfully apply market cycle analysis in your trading strategy, it’s essential to leverage HIBT analysis tools effectively. Here are key components to consider:

1. Data Visualization

Analyzing historical price charts can help identify patterns. HIBT tools typically provide visual aids that showcase past cycles, enabling investors to predict future trends.

2. Market Sentiment Analysis

Understanding market sentiment is crucial. Tools that aggregate social media sentiment can provide insights into community trends and reactions to market events.

3. Correlation with Economic Indicators

Evaluating correlations between Bitcoin prices and economic factors (like inflation rates or geopolitical events) can also aid in forecasting market movements.

Real World Applications of HIBT Tools

Here’s how traders can implement these tools practically:

- **Trend Following:** Follow historical price patterns and reinforce them with technical indicators to determine entry and exit points.

- **Risk Assessment:** Use volatility metrics from HIBT tools to assess potential risks associated with market entries.

- **Allocate Resources:** Tailor your investment strategy according to different phases of the market cycles using predictive analyses provided by HIBT platforms.

Vietnam’s Growing Crypto Market: A Case Study

As the crypto adoption rate in Vietnam surges, tools like HIBT’s Bitcoin market cycle analysis become invaluable.

According to a recent study, Vietnam’s number of cryptocurrency users has increased by over 150% in the past year. With a rapidly growing user base, understanding market cycles can significantly influence investments.

Local Insights: Adapting HIBT Tools in Vietnam

For Vietnamese investors, integrating local market dynamics with HIBT analysis tools can enhance trading strategies. For instance, the growing popularity of tiêu chuẩn an ninh blockchain in Vietnamese regulations offers additional layers of security for investments.

Practical Tools for Effective Market Cycle Analysis

Several platforms provide industry-leading analysis tools tailored for crypto traders. Below are a few notable mentions:

- CoinMetrics: Offers insightful metrics essential for Bitcoin cycle analysis.

- Glassnode: Provides on-chain data analytics that aid in understanding market cycles.

- TradingView: An excellent platform for data visualization through customizable charts.

Implementing Your Strategy

With the right tools and a solid understanding of market cycles, you can make informed decisions that align with your investment goals. Here’s a quick breakdown:

- Choose the right HIBT analysis tool.

- Keep an eye on market sentiment and macroeconomic factors.

- Adapt your strategies in line with observed market shifts.

Conclusion: Empower Your Trading with HIBT Tools

As we continue navigating the complexities of the cryptocurrency market, HIBT Bitcoin market cycle analysis tools provide critical insights necessary for successful trading strategies. Whether you are seasoned or new to the crypto space, these tools can significantly enhance your understanding of market dynamics, especially in rapidly growing markets like Vietnam.

In this volatile environment, staying informed and utilizing precise analytical tools ensures that you remain ahead of the curve. So equip yourself today with the knowledge and tools for smarter, risk-managed trading. For more on HIBT analysis tools, check out HIBT.com.

—

Written by Dr. Alex Thorne, a blockchain technology expert with over 10 years of experience in analyzing cryptocurrency markets, authoring numerous papers, and leading high-profile audits of blockchain projects.