Ethereum Gas Fees and Their Impact on Crypto Stocks

In recent years, the cryptocurrency market has experienced dramatic growth, leading to an increase in both interest and investment. However, as of 2024, we reported that over $4.1 billion had been lost due to security vulnerabilities and a lack of understanding among users in decentralized finance (DeFi). This alarming figure raises questions about the security of blockchain transactions and how this complexity also affects gas fees on networks like Ethereum. Understanding the gas fees is essential not only for seasoned investors but also for individuals entering this volatile market.

Understanding Ethereum Gas Fees

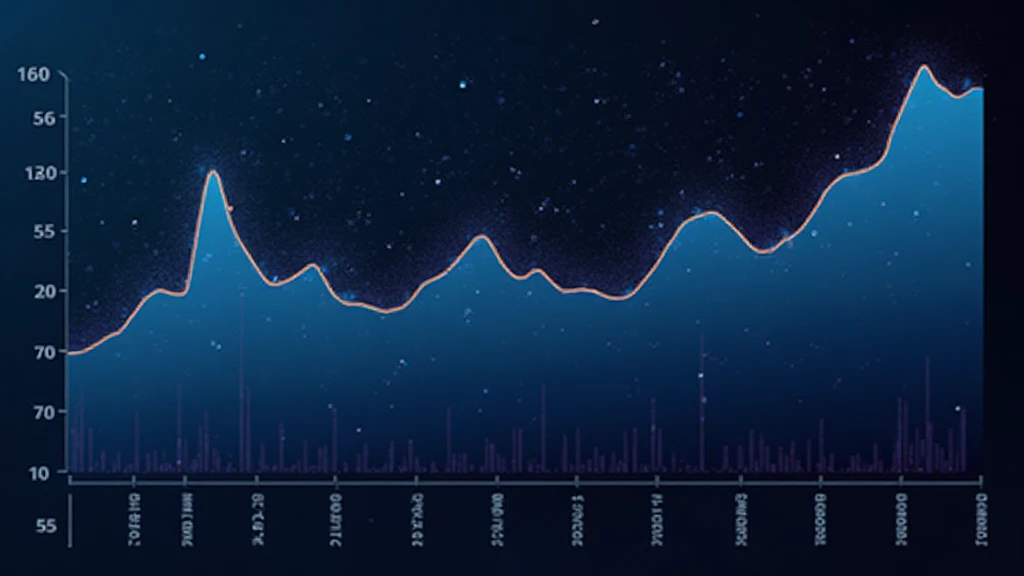

Ethereum gas fees represent the costs required to conduct transactions or execute smart contracts on the Ethereum blockchain. These fees can vary significantly based on network demand and other factors.

- Transaction Complexity: More complex transactions require more computational power, leading to higher gas fees.

- Network Demand: When the Ethereum network is congested, gas fees tend to spike because users bid against each other to have their transactions processed.

To explain this further, think of Ethereum gas fees as akin to a toll on a highway; the busier the road, the more expensive it becomes to drive on it.

Impact on Users and Investors

High gas fees can deter smaller investors from participating in the market. For instance, if a transaction incurs a fee of $50 and the token being purchased is worth only $100, the effective investment becomes far less appealing. According to recent analyses, the average Ethereum gas fee reached upwards of $20 in 2024, which has shown to impact trading volumes significantly.

Ethereum’s Role in the Cryptocurrency Ecosystem

Ethereum serves as a backbone for many innovations within the crypto space, including decentralized applications (dApps) and non-fungible tokens (NFTs). Understanding how gas fees influence these developments is crucial for investors.

- Decentralized Finance (DeFi): As the DeFi market continues to expand, the demand for transactions on Ethereum has surged, impacting gas fees significantly.

- NFT Market Trends: The average cost for gas fees directly influences the creation and trading of NFTs, thereby affecting the crypto stocks associated with these entities.

Given the exponential growth seen in the Vietnam crypto market, where users have increased by over 40% in the past year, understanding Ethereum’s dynamics is even more critical.

What Affects Gas Fees on Ethereum?

Several factors affect Ethereum gas fees:

- Market Conditions: During market fluctuations, gas fees can change based on the urgency with which users want their transactions completed.

- Innovations in Layer 2 Solutions: Technologies like Optimistic Rollups are developed to mitigate the high gas fees, allowing transactions more efficiently and cost-effectively.

Exploring Crypto Stocks Interconnected with Ethereum Gas Fees

As an investor, understanding how Ethereum’s gas fees impact the broader crypto stock market can lead to more informed decisions. Many crypto stocks are closely tied to the Ethereum ecosystem.

- Blockchain Infrastructure Companies: Companies that build on Ethereum or that provide tools and services for Ethereum transactions often see their stock prices influenced by fluctuations in gas fees.

- Investing in Innovation: Keeping an eye on companies that develop solutions for reducing gas fees, like interchange protocols, is critical for forward-thinking investments.

For instance, in 2024, companies focusing on Layer 2 solutions saw stock price increases of over 30% due to heightened investor interest.

Long-term Outlook for Ethereum Gas Fees

The landscape for Ethereum gas fees is continually evolving. With Ethereum transitioning to a proof-of-stake (PoS) consensus mechanism, the environmental impact and scaling challenges are expected to improve. Investors should remain informed on:

- Technological Improvements: Upgrades like EIP-1559 have attempted to stabilize gas fees.

- Market Sentiment: As more users adopt Ethereum, the sentiment surrounding it can greatly influence gas fees and consequently, the performance of crypto stocks.

Understanding these dynamics enhances one’s ability to navigate the complexities of the cryptocurrency market.

Local Insights: The Vietnamese Crypto Market

As of 2024, Vietnam has emerged as a notable player in the crypto market, with its user base exhibiting an impressive growth rate of approximately 45% from the previous year. This growth represents significant opportunities for both local investors and foreign entities wishing to enter this burgeoning market.

- Regulatory Landscape: Vietnam’s government is increasingly open to crypto regulations, favoring a more stable environment for investors.

- Charging Ahead: Local startups are innovating new solutions to lower transaction costs and enhance digital asset security, responding to market needs.

Understanding the global implications of Ethereum gas fees in conjunction with local trends empowers Vietnamese investors to make informed decisions.

A Look into Future Trends

As we look forward, anticipating changes within the Ethereum network can provide unique investment insights. Predictions suggest:

- Stabilization of Gas Fees: Continuous improvements in Ethereum’s technology may reduce the volatility of gas fees.

- Innovative Financing Options: As Ethereum remains the leading platform for smart contracts, innovative financing can become more accessible.

Investors should consider these trends as integral factors influencing their strategies in the crypto stocks market.

Conclusion

Understanding Ethereum gas fees is crucial when investing in crypto stocks. As Ethereum’s role within the cryptocurrency ecosystem continues to evolve, so too will the implications for investors. Staying ahead of developments in gas fees while considering local market trends in Vietnam—where the crypto user base has seen substantial growth—can lead to informed decision-making in this fast-paced environment.

As always, remember that this article does not constitute financial advice, and investors should conduct thorough research and consult local regulations for their specific circumstances.

For more insights into the evolving world of cryptocurrency, visit cryptopaynetcoin.

Author: Dr. Nam Tran, a blockchain analyst with over 15 published papers in the field, known for leading smart contract audits for top-tier projects.