DAO Governance Models: Exploring Future Trends in Decentralized Decision-Making

With approximately $4.1 billion lost to decentralized finance (DeFi) hacks in 2024, the need for robust governance frameworks has never been more evident. DAOs, or Decentralized Autonomous Organizations, stand at the forefront of this evolution, offering innovative approaches to community-led decision-making. This article delves into the myriad DAO governance models, pinpointing their significance for platforms like cryptopaynetcoin.

Understanding DAO: The Backbone of Decentralized Governance

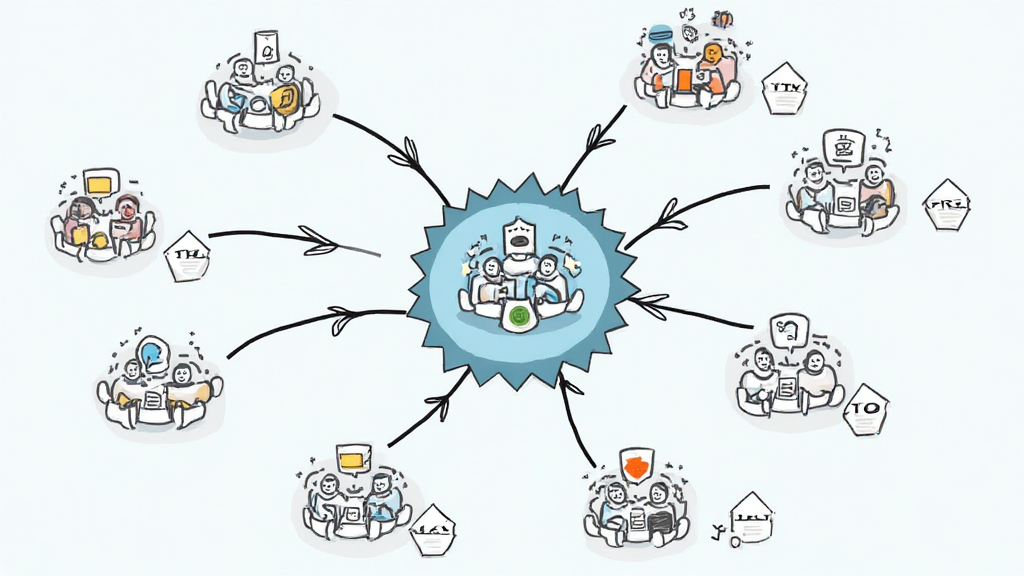

Decentralized Autonomous Organizations, or DAOs, represent a fundamental shift in how decisions are made within cryptocurrency communities. Unlike traditional organizations, DAOs leverage smart contracts on blockchain technology to facilitate governance processes without centralized control. This unique structure fosters transparency and encourages active participation—from voting on critical proposals to allocating resources effectively.

In Vietnam, where the tiêu chuẩn an ninh blockchain is gaining traction, its population is increasingly engaging with blockchain solutions. Reports show a growing number of Vietnamese users, with an astonishing growth rate of 130% in crypto adoption over the past year.

DAO Governance Models: A Closer Look

DAOs can be categorized into various governance models, each serving specific community needs. Let’s dissect some of the most prominent ones:

- Token-Based Governance: In this model, voting power is directly tied to the amount of tokens a member possesses. It’s akin to shareholders in a corporation, where those with greater investments wield more influence. For example, projects like MakerDAO utilize this approach to ensure those who contribute more to the ecosystem can shape its future.

- Quadratic Voting: This innovative mechanism allows users to allocate votes based on the intensity of their preferences rather than the sheer number of tokens. Quadratic voting seeks to balance power, enabling collective decisions that account for minority opinions. This model is currently being trialed by several DAOs seeking to democratize governance further.

- Liquid Democracy: Here, stakeholders can either vote directly on proposals or delegate their voting power to trusted representatives. This flexible approach can enhance participation rates, particularly in larger DAOs, where direct voting may not be feasible.

Pros and Cons of Various Governance Models

As with any system, DAO governance models possess strengths and weaknesses. Here’s a breakdown:

| Model | Advantages | Disadvantages |

|---|---|---|

| Token-Based | Simple to understand, encourages investment. | Wealth concentration may lead to disproportionate influence. |

| Quadratic Voting | Amplifies minority voices, prevents tyranny of the majority. | Complexity may deter participation. |

| Liquid Democracy | Flexible, allows for both direct and representative influence. | Delegation could lead to apathy among voters. |

Successful DAO Case Studies

To grasp the practical implications, let’s explore a few DAOs that have applied these models successfully:

- MakerDAO: A pioneer in decentralized finance, MakerDAO utilizes token-based governance to allow MKR holders to vote on protocol changes and risk parameters.

- Gitcoin: This DAO promotes open-source development via community funding and employs quadratic voting to prioritize projects that resonate most with contributors.

- Aragon: With a focus on creating a flexible governance platform, Aragon enables projects to customize their governance structures, ranging from token-based to liquid democracies.

The Role of DAOs in Vietnam’s Crypto Landscape

As Vietnam’s cryptocurrency market expands, the role of DAOs is becoming increasingly significant. Local startups are beginning to explore decentralized governance models, showing promising results. DAOs represent a promising avenue for nurturing innovation and cooperation among Vietnamese developers.

In 2023, the Vietnamese government issued regulations aimed at promoting blockchain technologies, paving the way for more DAOs to emerge within the region. Such support can significantly enhance the adoption of DAO governance models and ensure compliance with local regulations.

Future Trends: Where Are DAO Governance Models Heading?

As we move forward, the evolution of DAO governance models will likely reflect broader trends within the crypto industry:

- Enhanced Accessibility: As educational resources grow, more users will understand DAOs, making governance more inclusive.

- Interoperability: The rise of cross-chain compatibility may lead to hybrid governance models that leverage the strengths of multiple platforms.

- Increased Regulation: As governments impose regulations on the crypto industry, DAOs will need to adapt their models to ensure compliance while maintaining decentralization.

Conclusion: The Future of DAO Governance Models and Their Impact on Cryptopaynetcoin

As highlighted throughout this article, DAO governance models play a crucial role in shaping the future of decentralized decision-making and community development. By examining successful implementations and recognizing the unique dynamics within markets such as Vietnam, platforms like cryptopaynetcoin can navigate the complexities of the crypto landscape effectively.

To sum it up, understanding DAO governance models is imperative for stakeholders in the crypto ecosystem, empowering them to foster community engagement and drive innovation.

***Disclaimer: This article does not constitute financial advice. Consult with local experts and regulators before engaging in cryptocurrency activities.***

Authored by Dr. Alex Nguyen, a recognized authority in blockchain technology, with over 15 published papers and pivotal involvement in multiple high-profile blockchain audits.