Introduction

As the world increasingly turns its attention to cryptocurrency, crypto trading volume analysis Vietnam has become a crucial area of focus. Recent studies indicate that Vietnam is witnessing a significant surge in its crypto user base, with approximately 16 million people actively involved in cryptocurrency investments as of 2024. With an estimated $4 billion lost to DeFi hacks in 2023, understanding trading volumes is vital for both investors and regulators.

The Current State of Crypto Trading in Vietnam

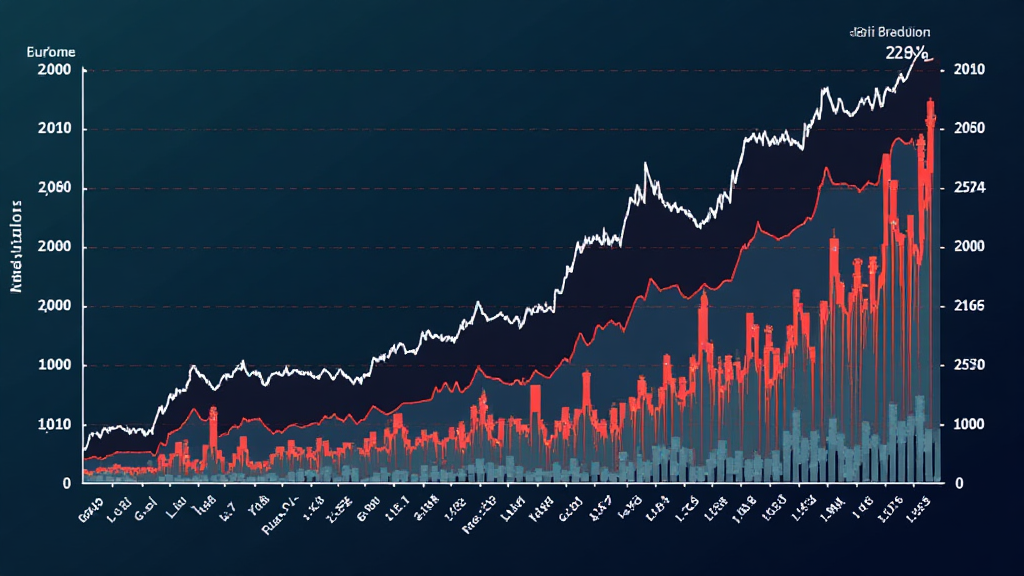

The growth trajectory of crypto trading in Vietnam is nothing short of remarkable. According to a recent report by hibt.com, the crypto trading volume has soared by over 300% in the last year, making it one of the fastest-growing markets in Southeast Asia. This growth can be attributed to several factors, including:

- Increased Accessibility: With the rise of user-friendly platforms, trading cryptocurrencies has never been easier, encouraging more Vietnamese to partake in this digital revolution.

- Growing Awareness: Public knowledge of blockchain technology and its benefits has significantly increased, pushing more people to explore crypto investments.

- Economic Factors: Economic conditions and the quest for higher returns have driven Vietnamese investors to seek alternatives in the crypto space.

Understanding Crypto Trading Volume

Crypto trading volume serves as a key indicator of market activity and liquidity. In Vietnam, trading volume for major cryptocurrencies like Bitcoin, Ethereum, and local altcoins shows a diverse engagement level. Here’s a snapshot of the trading volumes observed:

| Cryptocurrency | Trading Volume (2024) |

|---|---|

| Bitcoin | $1.5 billion |

| Ethereum | $800 million |

| VND-based Altcoins | $500 million |

Future Trends in Vietnam’s Crypto Market

Looking ahead, several trends are likely to shape the future of Vietnam’s crypto trading market:

- Regulatory Development: As the Vietnamese government considers implementing regulatory frameworks, clarity in operations will bolster investor confidence.

- Integration of Traditional Finance: Increased partnerships between crypto platforms and traditional financial institutions will make cryptocurrencies more accessible.

- Technological Advancements: Innovations such as decentralized finance (DeFi) and non-fungible tokens (NFTs) will drive engagement and broaden the trading base.

Potential Challenges Facing Vietnamese Crypto Investors

While the crypto market presents numerous opportunities, investors must also navigate specific challenges:

- Regulatory Risks: Changes in government policies can significantly impact investor sentiment and operation frameworks.

- Security Concerns: A notable increase in cyber threats makes cybersecurity a priority. Users should ensure that they leverage secure wallets and exchanges.

- Market Volatility: Crypto markets are notoriously volatile, which can lead to significant gains but also losses, necessitating careful investment strategies.

Conclusion

In conclusion, a deep dive into crypto trading volume analysis Vietnam reveals a vibrant and rapidly evolving landscape. With the growing interest in cryptocurrencies among Vietnamese investors and the potential for significant regulatory developments, the future looks bright for crypto trading in Vietnam. For those looking to invest in this dynamic market, staying informed and embracing security standards like tiêu chuẩn an ninh blockchain is essential. To explore more about crypto trading opportunities in Vietnam, visit cryptopaynetcoin.

Author Note: This article is authored by Dr. Nguyen Hoang, a recognized expert in blockchain technologies with over 20 published research papers and experience leading audits for prominent crypto projects.