Introduction

With an estimated $4.1 billion lost to crypto margin trading scams and hacks in 2024, understanding the risks associated with this trading strategy is more critical than ever. Whether you are a seasoned trader or a newcomer to the crypto space, the complexities of margin trading can lead to significant financial losses if not approached with caution. This article delves into the various risks of crypto margin trading, providing insights on how to mitigate them effectively.

What is Crypto Margin Trading?

Crypto margin trading allows traders to borrow funds to increase their buying power, enabling them to amplify their potential profits. However, this practice also increases exposure to losses. Here’s what you need to know:

- Definition: Margin trading involves using borrowed capital to invest, increasing both potential returns and risks.

- Mechanism: Traders deposit a percentage of the total trade value as margin, borrowing the rest from a broker or platform.

- Leverage: This practice involves leveraging funds, often seen as a double-edged sword.

The Risks of Crypto Margin Trading

Let’s break down the main risks involved in crypto margin trading:

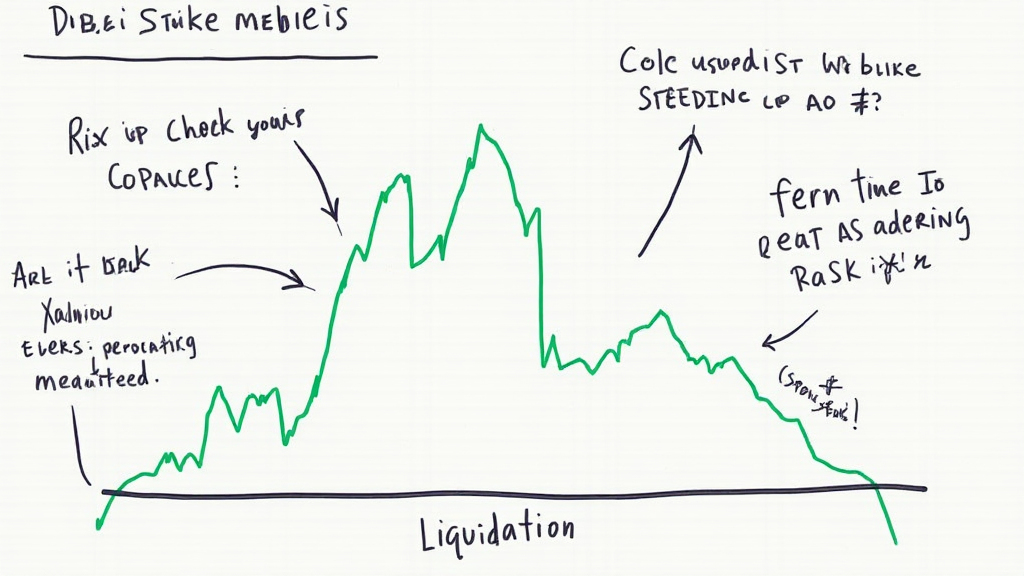

1. Liquidation Risks

One of the most notable risks in margin trading is liquidation. If a trader’s asset value drops significantly, the broker can liquidate the assets to repay the borrowed funds.

- How it works: When an asset price falls below a certain threshold, the broker automatically sells the position to recover their loan.

- Example: For instance, a trader leveraging 10x must maintain a 10% value in their account; falling below this mark triggers liquidation.

2. Market Volatility

The cryptocurrency market is known for its extreme volatility. Price fluctuations can lead to rapid gains or severe losses.

- Impact: A sudden downturn can wipe out a trader’s margin account, resulting in a total loss.

- Data Point: According to reports, Bitcoin’s price experienced a 40% drop in one week back in 2022.

3. Interest Costs

Trading on margin incurs interest costs for the borrowed funds, which can accumulate quickly.

- Hidden Fees: These costs may not be apparent initially, impacting profitability.

- Consideration: Traders must factor in interest in their risk assessments.

4. Psychological Stress

Margin trading can lead to significant emotional stress due to financial stakes involved.

- Fear and Greed: Traders may act irrationally, leading to poor decision-making.

- Coping Mechanisms: It’s essential to establish a trading plan and stick to it.

5. Regulatory Risks

Regulations surrounding margin trading can vary significantly by jurisdiction.

- Compliance: Failure to adhere to local laws can result in penalties.

- Example: In Vietnam, the rapid growth of crypto trading has prompted increased scrutiny and regulation.

How to Mitigate the Risks

While the risks of margin trading are considerable, there are strategies for traders to protect themselves:

1. Use Stop-Loss Orders

Setting up stop-loss orders can prevent excessive losses by automatically selling assets once they reach a specific price point.

2. Understand Leverage

Being aware of how leverage works and choosing an appropriate level can help manage risk. Opt for lower leverage when starting.

3. Diversify Portfolio

Rather than investing solely in one crypto asset, diversifying can help reduce overall risk.

4. Keep Up With Market Trends

Stay informed on market trends and news that could affect asset prices significantly.

5. Seek Professional Advice

Consulting with financial advisors knowledgeable in crypto can provide valuable insights into mitigating risk.

Case Study: The Vietnamese Market

In Vietnam, the interest in margin trading has surged, with a growth rate of over 100% year-over-year. However, this increased interest has also attracted regulatory attention, leading to discussions around the need for protective measures in trading practices.

Conclusion

Crypto margin trading presents a unique set of risks that every trader should understand. By recognizing these risks, such as liquidation, market volatility, and psychological stress, traders can implement strategies to protect their investments effectively. In a rapidly evolving market like Vietnam, where user engagement continues to climb, staying informed and cautious is critical to achieving success in the crypto space. By leveraging tools like stop-loss orders and maintaining a diversified portfolio, traders can enjoy the benefits of margin trading without falling prey to its inherent risks. Remember, investment strategies should always be tailored to your risk tolerance and financial goals, so keep these considerations in mind. For more resources on crypto trading, visit cryptopaynetcoin.