Introduction: Understanding the Importance of Position Sizing in Cryptocurrency Investment

As the cryptocurrency landscape continues to evolve, many beginners are entering the market with hopes of striking it rich. In Vietnam, where cryptocurrency adoption has surged, understanding the nuances of position sizing becomes essential. In 2022 alone, Vietnam recorded a 5.5% increase in cryptocurrency users, reflecting growing interest.

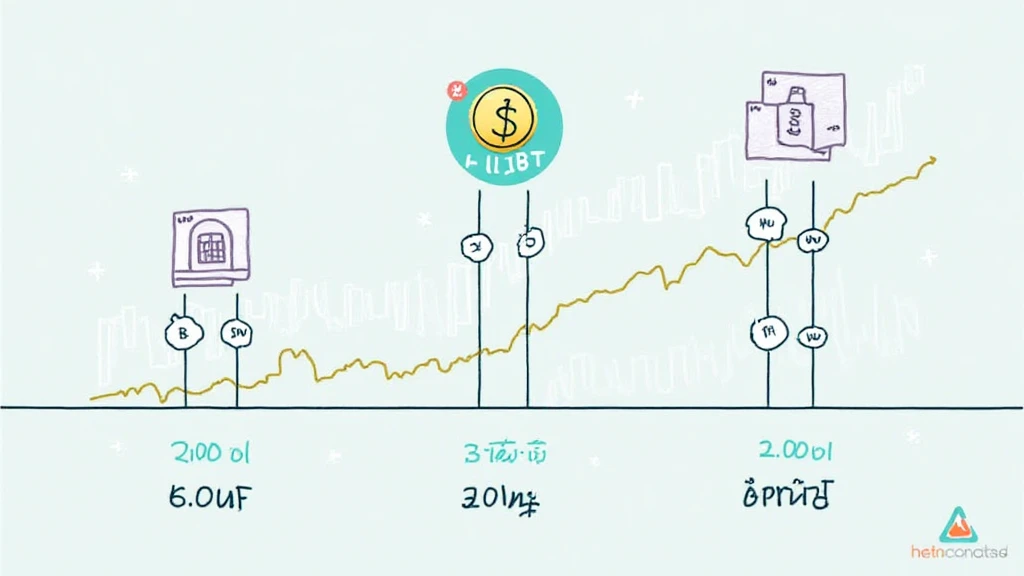

However, despite the potential rewards, many make the fatal mistake of not adequately sizing their positions. Position sizing essentially dictates how much of a particular asset you should buy or sell, not just based on your total capital but also on your risk tolerance. Here’s the catch: an intricate strategy known as HIBT position sizing can significantly mitigate risks during trading.

What is HIBT Position Sizing?

The term HIBT stands for High Impact, Balanced Trading, which focuses on maintaining a balance between risk and profitability. For beginners, let’s break it down:

- High Impact: Aiming for high-reward trades that could dramatically influence your investment portfolio.

- Balanced: Ensuring that these risky trades are counterbalanced with safer investments.

- Trading: Continually adjusting positions based on market movements.

This strategy minimizes the exposure to any single asset and spreads the risk across various investments.

Why Position Sizing Matters?

Many traders underestimate the importance of position sizing. According to a study by Investopedia, incorrect position size can lead to devastating financial losses. Instead, think of it as a way to secure your profits and shield yourself from market volatility. In fact, around 80% of traders who fail cite poor risk management as a key reason.

How to Implement HIBT Position Sizing: A Step-by-Step Guide

Let’s look at a simple yet effective method for implementing HIBT position sizing:

- Determine your total trading capital: This is the total amount of money you have set aside for trading.

- Set your risk tolerance: Before diving in, determine how much you can afford to lose on a single trade. A common rule is risking only 1-2% of your total capital.

- Example: If your total capital is $10,000, you might allow yourself to risk $100-$200 per trade.

- Calculate position size: Use this simple formula:

Position Size = (Total Capital) * (Risk per Trade) / (Trade Risk) - Adjust as needed: Review regularly and adjust your position size based on market conditions.

Example of HIBT Position Sizing

Suppose you have a total capital of $10,000 and decide to risk 2% ($200) on trading a particular cryptocurrency. If you determine the trade risk (the difference between your entry point and stop-loss) is $10, your position size would be:

Position Size = ($10,000 * 0.02) / $10 = 20

This means you should buy 20 units of the cryptocurrency to stay within your risk tolerance.

Common Pitfalls When Starting with HIBT Position Sizing

While adopting a structured approach is beneficial, beginners often fall into traps that can compromise their efforts. Here are some common pitfalls to avoid:

- Ignoring Risk Management: Always prioritize risk management over potential gains. Without it, you may find yourself losing more than anticipated.

- Over-Leveraging: Using margin can amplify profits but also magnify losses. Be cautious and ensure you don’t over-leverage your positions.

- Emotional Trading: Stick to your plan and avoid making impulsive decisions based on fear or greed.

The Role of Market Data in HIBT Position Sizing

Utilizing market data can provide vital insights that bolster your HIBT position sizing strategy. For instance, here’s a table showcasing recent cryptocurrency market data in Vietnam:

| Cryptocurrency | Market Cap (Billion USD) | 2022 User Growth (%) |

|---|---|---|

| Bitcoin | 800 | 10 |

| Ethereum | 200 | 15 |

| Binance Coin | 50 | 20 |

Above data can help you gauge market interactions and adjust your position accordingly.

Integrating HIBT with Other Investment Strategies

To maximize gains while minimizing risks, integrating HIBT position sizing with other investment strategies can be effective:

- Dollar-Cost Averaging: Invest regularly, regardless of price. This can help minimize the impact of volatility.

- Portfolio Diversification: Spread your investments across various assets to cushion against market downturns.

The Future of HIBT Position Sizing in Vietnam’s Cryptocurrency Market

As Vietnam’s cryptocurrency industry matures, the demand for sound investment strategies like HIBT position sizing is only expected to rise. According to data from Statista, the number of crypto users in Vietnam is projected to reach 8 million by 2025. With this growth comes the necessity to educate beginners on how to navigate the markets smartly.

Conclusion: Your Path Ahead with HIBT Position Sizing

Embracing the principles of HIBT position sizing can serve as a sturdy base in your cryptocurrency trading journey. Remember, managing your position size effectively can be the difference between chronic losses and consistent gains. Equip yourself with the necessary tools and knowledge to thrive in this exciting market.

For more insights on cryptocurrency investment strategies, visit HIBT.com.

As the cryptocurrency world continues to evolve, staying abreast of industry trends and developing effective strategies can make a world of difference. Start applying the HIBT position sizing principles today and secure your investments for a prosperous future!

Author: Dr. William Tran – A blockchain consultant and cryptocurrency researcher with over 15 published papers in financial technology and compliance. He has led audits for notable blockchain projects.